You’ve heard the noise - Bitcoin has no value, it’s a bubble, it’s a scam.

The news says it. Your coworker repeats it.

But some of the most influential figures in global finance see things differently.

While the masses mock what they don’t understand, smart money is already positioning.

“If sovereign wealth funds allocate just 2–5% of their portfolios to it, we could see Bitcoin reach $700,000 per coin.”

“Bitcoin is becoming a store of value. Just like gold, it’s emerging as a way to preserve wealth outside of traditional financial systems.”

“You will see ALL traditional finance service companies go head first into Bitcoin. That’s what’s going to happen, and it’s coming. Bitcoin is going to go much higher.”

“Our research predicts a price close to $3M a coin in the scenario where it’s adopted as the reserve asset globally.”

If Bitcoin were a business

it would be the best performing

business ever created

Bitcoin has processed over 1 billion secure transactions globally since its inception

It has been legalized in almost every country on earth

Bitcoin’s price in USD has grown over 1,500% in the last 5 years

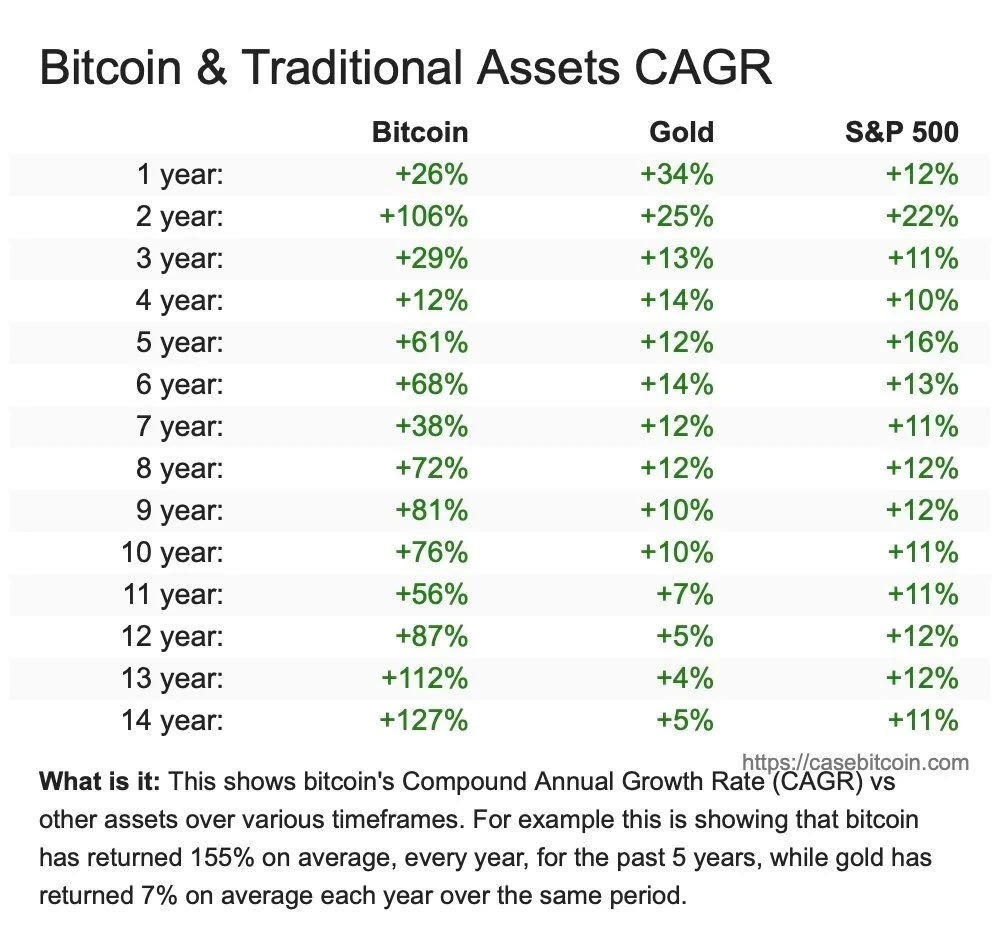

Causing Bitcoin to outperform every major asset class with an average 155% CAGR

How has this happened?

Over $35B has been invested in Bitcoin infrastructure.

With over 1 Million Bitcoin miners operating globally

Making Bitcoin the most secure and decentralized payment system in existence

Nations

States

Leading to record levels of mainstream adoption

Institutions

Corporations

All with no CEO, no Employees

no marketing plan, and no sales strategy

Bitcoin is the apex predator of monetary technology

Built on 40 years of computer science, cryptography, and macro economics

Bitcoin is designed to fix the problems inherent to fiat

U.S. M2 Money Supply Increasing

Because governments and central bankers are addicted to printing money

And unfortunately the United States is in an accelerating debt spiral

And all major currencies are losing purchasing power at the same time

While the bond markets are echoing 2008

And history clearly shows cycles of currency dominance and decline

It is extremely likely the dollar will suffer the same fate as those that came before it

Based on human nature,

history, and macro economics

it is impossible to reverse course

But Bitcoin has a fixed supply of 21 million coins. Which means it can never be inflated by money printing

Unlike the dollar, Bitcoin preserves your purchasing power over time

Bitcoin allows you to self-custody, and not rely on 3rd party banks that tend to fail

And is kept online by tens of thousands of decentralized Bitcoin nodes all over the world

Which reduces Government’s Control

and ability to Spend Money

Because the government spends alot of money

Like on the military industrial complex

healthcare, hitting lowest life expectancy ever

and education, without any success…

The government is notorious for horrible allocation of capital

But thankfullly, Bitcoin is in the hands of the people, and not governments

Fiat Money…

Centralizes Control

to spend without oversight

Spends Irresponsibly

without measurable efficacy

Inflates until collapse

from government printing

While Bitcoin…

Decentralizes Money

so banks can’t hold you hostage

Gives you control

to save & spend locally & responsibly

Stops Inflation

from government printing

Bitcoin is growing faster than the internet did in the 90’s

…and we are now entering the next phase of global adoption

There was a separation of church

and state in the 18th century